Creating Dynamic Support and Resistance Levels Using MT5 Trendlines

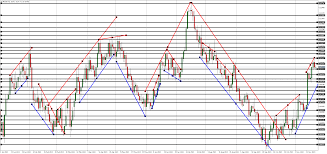

In the forex and CFD worlds, dynamic support and resistance levels are perhaps the best and most enduring techniques employed by veteran traders. These levels act as major decision points where buying or selling market momentum could either pause, change direction, or accelerate. While most traders use static horizontal levels based on past highs and lows, more advanced traders employ moving averages, price channels, and even trendlines to guide their trades and form dynamic support and resistance levels. For prop firm traders who prefer a rigid trading framework, these preset dynamic levels make it easy to correspond with actual market conditions while keeping strict order control. The MT5 drawing application also increases the usefulness of trendlines owing to its sharp creation features and chart alterations options.

“Smoothing Out the Edges” of Support and Resistance

Unlike moving averages, pushing age resistance dynamic changeable figure support and dynamic resistance levels adhere to the angle of a market trend. Instead of flat static levels, these shift with time while price action still happens. Revolving price action usually incorporates bounded elements such as moving averages, price channels, and even graphs. Most notably, trend lines really do stand out as they are based on set market swing points that most traders pay attention to, thus portraying the ongoing buyer-seller’s market psychology.

These levels are particularly important in choppy markets, where prices may not return to the same static highs or lows. A properly drawn trendline on the MT5 trading platform enables traders to monitor the movement of the price and forecast pullbacks considering value analysis. Dynamic levels are useful particularly for breakout and continuation strategies where traders seek to find re-entries in the direction of prevailing market trends.

Drawing Accurate Trend Lines in MT5

In the MT5 trading platform, one can easily edit and draw in trend lines as the interface is user-friendly. For each swing point, the drawing tool has a line tool that draws from one swing point to the other, with the option of extending it forward for future interaction zones. The most useful trendlines are those with at least two significant swing lows in an uptrend, or two swing highs in a downtrend. One of the advantages of using MT5 is its flexibility. Aside from adjusting the angle of the trendline, you can lock the trendline to specific time frames, set the angle, and choose the color and style to enhance visual clarity.

In order for trendlines to act as dynamic support or resistance levels, they need to be anchored to swing points that the market has respected over time. Lines that are placed arbitrarily will provide no actionable insight. Traders should strive to create lines which have been reacted to repeatedly by the market, indicating other market participants validate their opinion.

A common recommendation is to place the starting point of the trendline at the major low or high and the subsequent point at the next verified lower high or higher low. From this point, MT5 has the ability to project the line into the future. As new price data comes in, traders can observe how price responds to these lines and make changes if necessary.

How Trendlines Assist Prop Firm Traders in Keeping Structure

Traders employed by a prop firm have their own specific issues to deal with. They have to operate within very tight borders for risk, drawdown per day, and frequently predetermined limits on how long trades are held for and total exposure allowed on the account. In such a case, structure becomes of utmost importance. Losing a funded account or failing an evaluation due to random or emotionally driven trading is all too easy.

Support and resistance that are based on a dynamic trend line provide a clear approach to how you will interact with the market. Instead of placing trades based on instinct or employing news-based methods, prop traders have a system where they can rely on regions defined by trend lines which always repeat. Consider the following example: during an uptrend, a trader may decide to wait for the price to pull back to an ascending trendline before thinking about executing a long trade. A dynamic support level allows for the presence of a logic entry point alongside an obvious point for an invalidation level.

In addition, trendlines on MT5 may be integrated with other tools, like Fibonacci retracements or certain significant candlestick patterns, to formulate trade setups that are high-probability. Prop firms greatly appreciate this composite method since it diminishes randomness and enforces discipline on analysis.

Integrating Trendlines with Multi Timeframe Analysis

Support for multiple timeframes is one of the core strengths of the MT5 trading platform. Traders are able to conveniently view one-minute to monthly charts, which is crucial in constructing a flexible perception of support and resistance.

By drawing trendlines on the higher time frames like H4 or daily chart, a trader can ascertain the overarching framework of the market. On lower time frames like M15 or M5, these lines act as dynamic support or resistance. A trendline drawn from daily swing lows helps guide intraday entries ensuring that the trader is riding the daily trend.

For these prop firm traders, this approach seems to suit them best. A large number of these firms encourage or mandate that traders prove sophisticated understanding of multi timeframe confluence. A trade taken at a dynamic support level confirmed on H1 and H4 for example is much more sophisticated than a reactive trade.

The Problems With Trendline Trading

As trendlines have a powerful stronghold, they are also open to abuse. Badly drawn trend lines tend to mislead traders, or perhaps even offer a misguiding sense of safety. While MT5 allows for easy adjustment of the trendlines, it is easier to anchor the lines without a defined and logical approach, thereby introducing potential mix-ups.

A further mistake that is frequently made is putting too much faith on trend lines without any other verification signs. Dynamic support as well as resistance points must be regarded as zones, not as exact lines. One candle closing above a trendline does not mean that the trendline is automatically invalidated. It is the responsibility of the traders to analyze how the price interacts with these areas; does it bounce off, ladder slowly and sit, or explosively break the area.

Do not overcrowd the chart with too much information. Trendlines can add unneeded ‘noise’ to the analysis. A trader must concentrate on the most crucial swing points and as the market shifts, remove outdated lines. With the MT5 trading platform, one can set the visibility lines for different time periods, making it possible to declutter the workspace without losing lines of importance.

Improving Strategies Based on Trendlines with the Use of MT5 Tools

MT5 is not about drawing lines. There are additional features which help complement its plethora of tools. This trendline based setup can be enhanced by other features like alert settings on objects that let traders receive alerts for price movement near a specified trendline. Proactive decision making is better than waiting and taking action too late.

MT5 permits the integration of overlays which may confirm validation of trendline interactions. For example, an exponential moving average in conjunction with a rising trendline can offer additional confirmation of dynamic support. The interaction between price retracing to the moving average and the trendline enhances the quality of the setup.

From the MT5 marketplace, custom scripts and indicators can automatically draw trendlines based on algorithmically identified swing highs and lows. Such tools, while helpful, should not fully replace manual evaluation, but can offer other viewpoints.

Why Modern Traders Cannot Ignore Dynamic Levels

The markets have become increasingly volatile as well as algorithm-driven, making static levels harder to rely on. Trendlines provide support and resistance levels in real-time, adapting to price movement, Static trend line support and resistance are widely used simpler techniques and are easy to understand. These characteristics improve their suitability for active traders, scalpers, and swing traders equally.

Adaptability is hugely important for a proprietary trader so they may wish to require flexibility in trading plans. while maintaining sound risk parameters. Trendlines offer the discipline needed, and their flexibility ensures the trader is not trapped dealing with outdated levels or irrelevant data.

This method helps with the mental aspects of trading as well. To a certain degree, confidence and emotional trading is maintained by clearly delineated responsive zones. Even in drawdown periods or uncertain times, confidence is preserved. Moreover, post-trade evaluation is enhanced because traders can quantify what dynamic levels did, assess price actions relative to them, and therefore, adapt their strategies accordingly.

Final Thoughts: With Trendlines on MT5, Your Trading Can Only Step Up

Responding to changing market conditions by setting dynamic support and resistance levels through trendlines marks a trader’s evolution from being strategic to being proactive. This platform MT5 offers professional-level drawing, time-frame multitasking, and customization options, making the latter approach even more accessible with advanced markup software. Whether trading on your own or bound by the proprietary trading firm regulations, using trendlines will improve your precision, order execution, and overall results.

It is not the best market forecasters who trade profitably, but traders who can adapt within the market’s pulse with discipline and precision. These factors allow incorporating dynamic trendlines into your trading which give a trader the much-needed visual and analytical approach, situating one’s trades within context rather than static context-defying frameworks. Learning these features on MT5 is another step toward intelligent and consistent trading.